- Silicon Valley’s luxury real estate market experiences a surge driven by the AI industry’s explosive growth.

- The median home price in Santa Clara County reaches $1.8 million, with sales of homes priced at $5 million or more spiking in April.

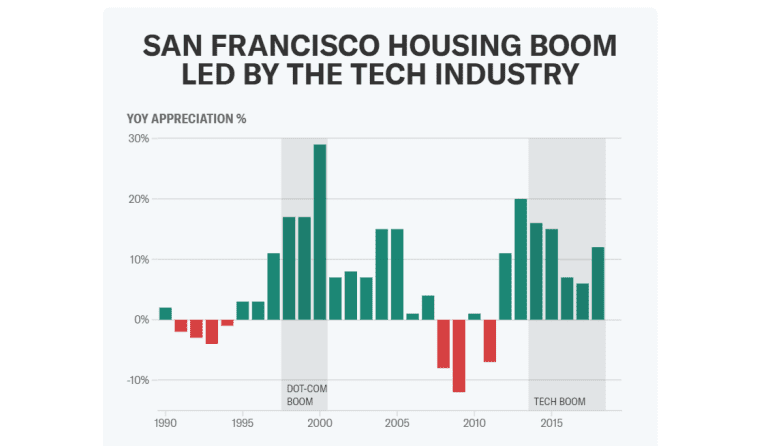

- Historical correlation between tech industry performance and real estate trends is evident, with past booms like the dot-com bubble and the rise of social media shaping the market.

- Demand for luxury homes surges, with properties often being swiftly snapped up within days of listing, driven by affluent tech industry professionals cashing out stock options.

- Opulent enclaves such as Palo Alto and Los Altos Hills witness scarcity in available homes, posing a challenge for high-end buyers.

- Despite cautious views, the expanding influence of AI on employment patterns could lead to a transformative shift in the broader housing market landscape.

Main AI News:

In the realm of Silicon Valley’s luxury real estate market, a dynamic surge has been witnessed, spurred by the meteoric rise of artificial intelligence (AI) enterprises. April witnessed a notable spike in sales of homes valued at $5 million or more within Santa Clara County, the nucleus of the famed tech hub. According to insights from real estate agency Compass, the median home price hovers at an impressive $1.8 million, indicative of the region’s burgeoning affluence.

The burgeoning success of tech enterprises, particularly those in the AI domain, stands as the cornerstone of this unprecedented surge. Patrick Carlisle, chief market analyst for the San Francisco Bay Area at Compass, underscores the pivotal role of tech advancements, citing the substantial uptick in stock market valuations, notably in the Nasdaq, which resonates profoundly within the Bay Area’s tech-centric landscape. This surge in household wealth instills a robust sense of confidence among prospective buyers, consequently amplifying their purchasing power in the luxury real estate sector.

Reflecting on Silicon Valley’s historical trajectory, it becomes evident that the region’s real estate fortunes have always been intricately intertwined with the ebbs and flows of the tech sector. Ken Rosen, a distinguished figure from the Berkeley Haas School of Business, underscores this correlation, affirming that home prices exhibit a high degree of correlation with the tech industry’s performance. From the dot-com bubble of the late 1990s to the post-financial crisis era marked by the proliferation of social media, each technological wave has heralded unprecedented wealth accumulation, invariably impacting the real estate landscape.

This year has witnessed a palpable uptick in demand for luxury residences, with local agents reporting a staggering influx of prospective buyers. Dave Walsh, vice president of the Compass office in Santa Clara County, highlights the fervent interest in luxury properties, exemplified by the substantial foot traffic observed during open house events. Furthermore, the accelerated pace of transactions underscores the region’s robust market dynamics, with homes often being swiftly snapped up within days of listing.

The nexus between the tech industry and the luxury real estate market is unmistakable, with Silicon Valley’s affluent denizens leveraging their newfound wealth to secure opulent residences. As companies like Nvidia and Advanced Micro Devices (AMD) spearhead the AI revolution, employees are propelled into the realm of affluence, wielding substantial equity stakes that translate into real estate acquisitions.

Indeed, the opulent enclaves of Palo Alto, Los Altos Hills, Los Altos, and Saratoga serve as epicenters of luxury living, boasting some of the most coveted addresses in the Bay Area. However, the scarcity of available homes poses a challenge for high-end buyers, with limited options available in the market. Nonetheless, for those fortunate enough to possess lucrative stock portfolios, the allure of transforming equity into tangible assets remains irresistible.

While some experts remain cautious about attributing the Bay Area’s housing boom solely to AI, the potential ramifications of the industry’s expansion cannot be discounted. As AI permeates various facets of daily life, its burgeoning influence on employment patterns could herald a transformative shift in the housing market landscape, extending beyond the realms of luxury to encompass the broader housing spectrum. With AI poised to become an omnipresent force in the coming years, its impact on the real estate sector is bound to be profound and far-reaching.

Conclusion:

The confluence of tech industry prosperity, particularly within the AI sector, and historical market trends indicates a robust luxury real estate market in Silicon Valley. With affluent tech professionals driving demand and scarcity of available homes in coveted enclaves, the housing market is poised for continued growth, albeit with potential shifts driven by the expanding influence of AI on employment and wealth accumulation patterns.