TL;DR:

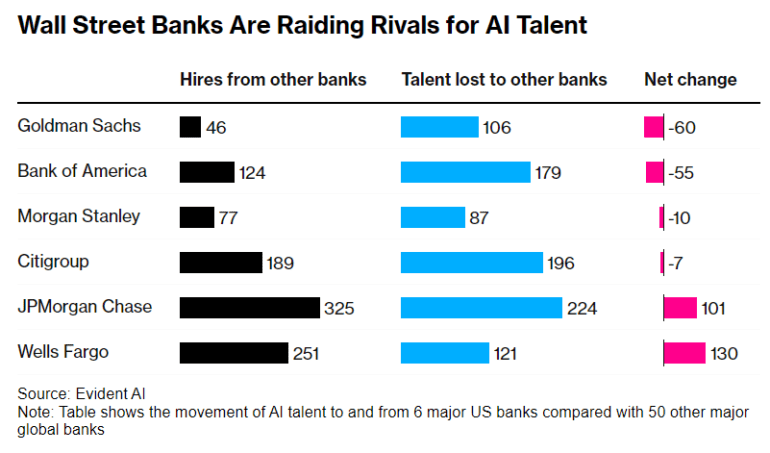

- Wall Street banks, including Goldman Sachs, are aggressively competing to attract AI talent.

- Goldman Sachs has seen a net loss of 60 AI professionals to rivals like Morgan Stanley and Citigroup in the past year.

- Bank of America also experienced a decrease in AI staff, while Wells Fargo saw a significant increase.

- Median compensation for AI roles in the US was $901,000, and in Europe, it was $676,000.

- The departures highlight the highly competitive landscape for AI talent in the finance sector.

- Banks are turning to AI to boost productivity and reduce costs, with Citigroup planning to equip 40,000 coders with AI capabilities.

- JPMorgan Chase is actively recruiting AI talent and has maintained its top position in the Evident AI Index.

- In the face of AI talent losses, banks are committed to investing in AI capabilities.

Main AI News:

In the high-stakes arena of finance, the battle for AI talent is reaching a fever pitch. Wall Street banks have been engaged in an intense competition to attract the brightest minds in the field, and one of the industry giants, Goldman Sachs Group Inc., finds itself on the losing end of this tug-of-war.

According to data compiled by the consultancy Evident, Goldman Sachs has witnessed a net outflow of 60 talented individuals to rival institutions like Morgan Stanley and Citigroup Inc. over the past 12 months through September. This exodus marks the highest among its major competitors. Bank of America, following closely behind, has experienced a decrease in staff by 55 members, while Wells Fargo & Co. has managed to secure the biggest net increase, adding 130 professionals to its ranks.

Alexandra Mousavizadeh, CEO of Evident, emphasized that it’s not merely about recruiting new talent but also about nurturing and retaining them. The competition for AI expertise is fierce, and professionals in roles related to data, analytics, and artificial intelligence command some of the highest compensation packages in the corporate world.

In the United States, the median compensation for employees in these roles reached $901,000 last year, including annualized equity grants. In Europe, professionals with similar experience took home an average of $676,000, as reported by the recruiting firm Heidrick & Struggles.

While these departures represent a fraction of the AI workforce at these banks, they provide valuable insight into the intense competition for AI talent. The financial industry is increasingly relying on AI to enhance productivity and reduce costs. Citigroup, for instance, is planning to empower its 40,000 coders with the ability to explore various AI technologies by the end of the first quarter.

Despite the losses, Goldman Sachs, with its vast global workforce of nearly 46,000 employees, is actively recruiting and investing in its AI capabilities. The bank recently welcomed Bing Xiang as a managing director and head of AI research, a significant hire from Amazon.com Inc.

While representatives for Goldman Sachs and other banks declined to comment, it is evident that AI strategy has become a cornerstone for success in the financial sector. As Mike Mayo, an analyst at Wells Fargo, aptly noted, “AI is here to stay.”

JPMorgan Chase & Co. is also deeply invested in AI, with thousands of open positions tied to the technology. CEO Jamie Dimon believes AI has the potential to shorten the workweek to just 3.5 days. In the Evident AI Index, which evaluates banks’ maturity in artificial intelligence, JPMorgan maintained its top ranking.

While JPMorgan has lost 224 AI-focused staff members in recent months, it has also added 325 during the same period, indicating a strong net increase in talent. Teresa Heitsenrether, JPMorgan’s Chief Data and Analytics Officer, expressed pride in the bank’s AI capabilities and its commitment to continued investment in this vital area.

Conclusion:

The intense competition among Wall Street banks for AI talent reflects the critical role of artificial intelligence in the financial sector. The talent war underscores the industry’s commitment to harnessing AI’s potential to enhance productivity and drive innovation. This trend is indicative of a growing reliance on AI technologies, which is likely to reshape the market dynamics and drive continued investments in AI capabilities among financial institutions.