TL;DR:

- Zelros introduces The Insurance Copilot, a game-changing Gen AI solution for insurance professionals.

- It leverages unified structured and unstructured data to provide real-time decision support.

- The Copilot empowers agents with insurance expertise, adaptability, centralized actions, efficiency, and accuracy.

- Zelros enhances its Marketplace with diverse scenarios and Gen AI use cases.

- Agents can improve their skills, access personalized recommendations, and harness the power of over 7,000 real-time recommendations.

Main AI News:

In the ever-evolving world of insurance, adaptability and innovation have become paramount for success. With global challenges like inflation and natural disasters, cost optimization is no longer an option but a necessity. Furthermore, the insurance industry is on the cusp of a technological revolution, with Global Generative AI expected to drive the Insurance Market to a value of $5,543.1 Mn by 2032, a significant leap from $346.3 Mn in 2022. However, even as the industry embraces cutting-edge technology, it faces another challenge – a shortage of skilled insurance professionals, driven by phenomena such as “the great resignation.”

Enter Zelros’ solution: The Insurance Copilot

While the term “Copilot” may not be entirely new, with Microsoft’s 365 Copilot and Google’s Duet AI making headlines, Zelros stands out for its unique approach.

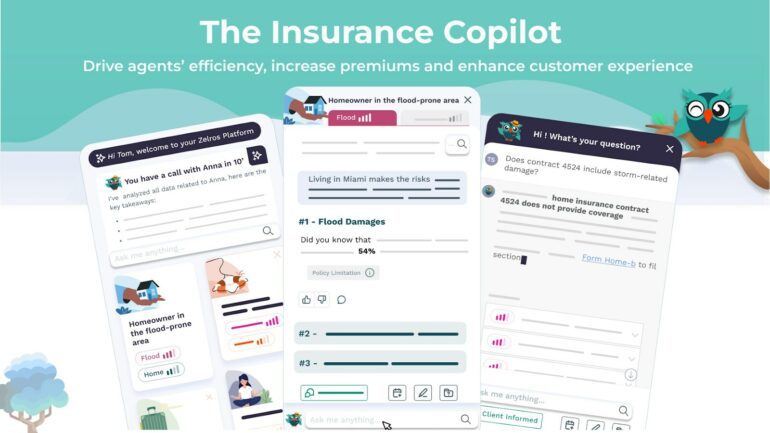

The Zelros Copilot is designed to support insurance agents, financial advisors, and customer service representatives who bear the daily responsibility of interacting with clients. Leveraging Generative AI and the company’s extensive industry experience, Zelros Copilot aims to empower agents to make quick, informed decisions, enhance productivity, and ultimately deliver superior service to policyholders. So, what makes The Insurance Copilot so special?

Gen AI Real-Time Decision Support: Unlocking the Power of Data

Zelros introduces a Gen AI real-time decision support system within its Copilot, harnessing the strength of unified structured and unstructured data to provide insights effortlessly. This groundbreaking feature revolutionizes agent and advisor support by offering contextual and expert assistance in understanding client needs, delivering personalized recommendations, reducing information search time, centralizing intelligence dynamically, and ensuring information accuracy. Zelros goes beyond simple answers and synthesizes insights, documents, and user feedback to provide not only answers but also proposed actions. The company’s strategic partnership with Microsoft further enhances its capabilities, allowing access to cutting-edge Large Language Models (LLMs).

Adaptability: Staying Ahead in the Knowledge Game

In the insurance industry, knowledge is power. Zelros ensures its system is dynamic and adapts whenever new, relevant data becomes available, avoiding the pitfalls of unreliable and outdated information. This adaptability keeps agents and advisors well-informed and prepared to provide the best possible service.

Centralized Actions for Seamless Operation

Zelros centralizes all intelligence, generating personalized answers from multiple data sources, including third-party data providers, APIs, documents, contracts, individual information, policy data, and claims data. Whether it’s searching for or sharing knowledge, this feature ensures a cohesive and collaborative workflow, alleviating the burden of intensive processes for agents and advisors. It allows them to focus on what truly matters – delivering a superior customer experience, efficient risk management, and operational excellence.

Efficiency and Accuracy: Reducing Information Overload

Employees often spend an average of 3.6 hours a day searching for information. Zelros significantly reduces this time, enabling agents and advisors to concentrate on customer experience, risk management, and operational efficiency. Furthermore, the system’s ability to provide accurate and relevant information in response to agent queries reduces errors, miscommunications and ensures compliance with regulatory policies.

Additionally, Zelros enhances its Marketplace with a broader range of relevant scenarios and use cases, harnessing the power of Gen AI to boost agents’ efficiency and skills with data-driven decisions. Agents can now import business system connectors to consolidate data, enrich client profiles, and access Gen AI productivity use cases and personalized recommendations directly from Zelros Insurance Marketplace.

With the power of +7000 ready-to-use and real-time recommendations, available for P&C, life, and SMB insurance, covering over 20 insurance products, Zelros equips agents with essential information to safeguard and proactively assist policyholders using impactful insights and persuasive arguments.

Conclusion:

The introduction of Zelros’ Insurance Copilot, powered by Gen AI, marks a significant step forward in the insurance industry. It addresses critical challenges such as information overload, skill shortages, and the need for personalized customer service. With its dynamic decision support and a robust Marketplace, Zelros is poised to reshape the market by empowering insurance professionals to provide more efficient, accurate, and customer-focused services. This innovation aligns with the evolving landscape of insurance, positioning companies for success in an increasingly competitive environment.